Nys Supplemental Tax Rate 2024. 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. Governor keeps promise to new yorkers:

The publication includes information on: What’s more—depending on income or locality within the state, some taxpayers.

The New York Bonus Tax Percent Calculator Will.

New york state offers a range of income tax rates, including 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%.

Don't Forget, The Deadline For Filing.

The publication includes information on:

1) Revised 2023 State Individual Income Tax Rate Schedules To Reflect Income Tax Rate Reductions;

Images References :

Source: jyotiqmelinde.pages.dev

Source: jyotiqmelinde.pages.dev

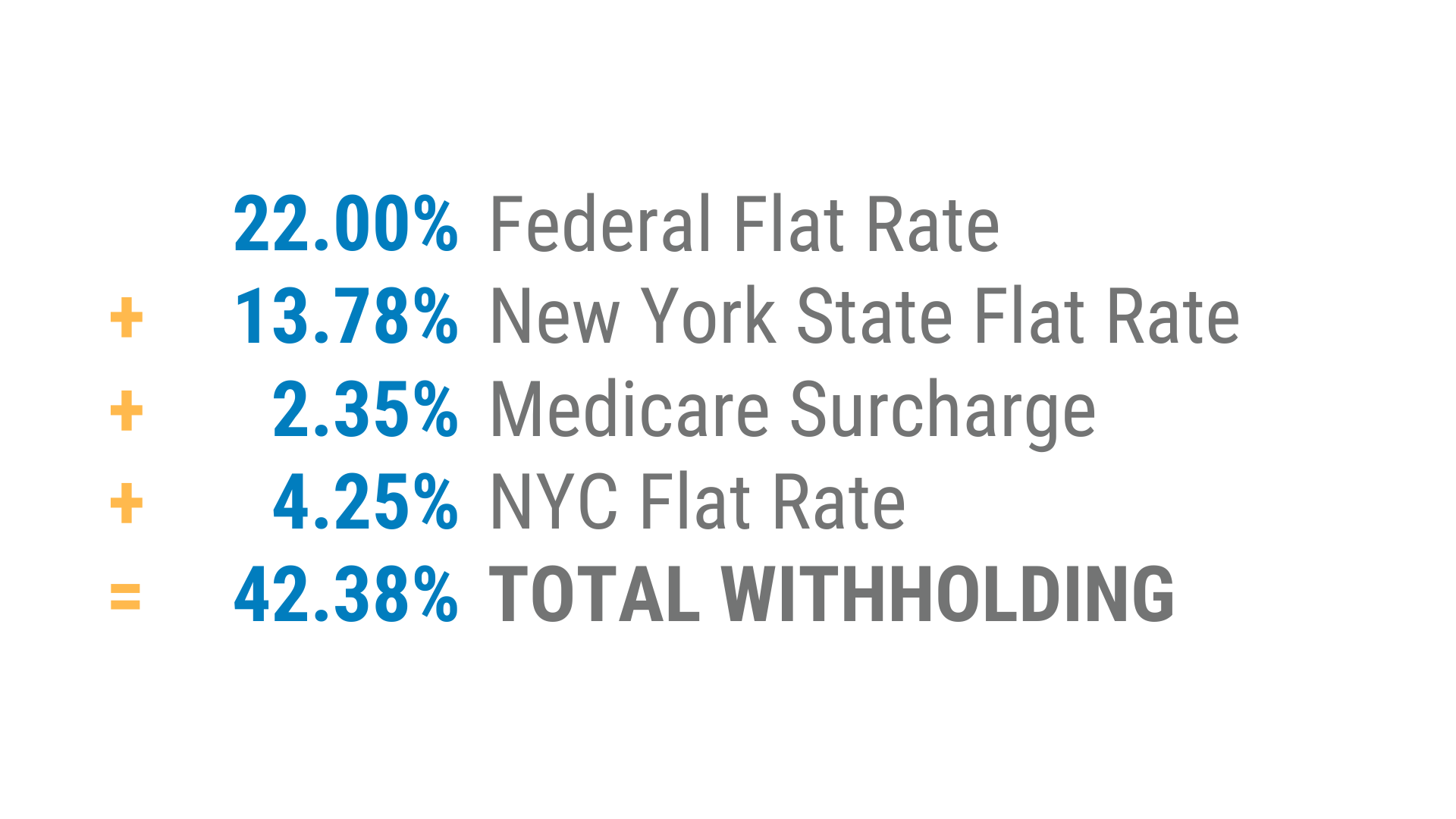

State Supplemental Tax Rates 2024 Dedra Evaleen, Don't forget, the deadline for filing. New york state and city.

Source: www.unclefed.com

Source: www.unclefed.com

Publication 15a Employer's Supplemental Tax Guide; Wage Bracket, New york state income tax tables in 2024. What’s more—depending on income or locality within the state, some taxpayers.

Source: www.unclefed.com

Source: www.unclefed.com

Publication 15a Employer's Supplemental Tax Guide; Formula Tables for, The new york bonus tax percent calculator will. How income taxes are calculated.

Source: www.reddit.com

Source: www.reddit.com

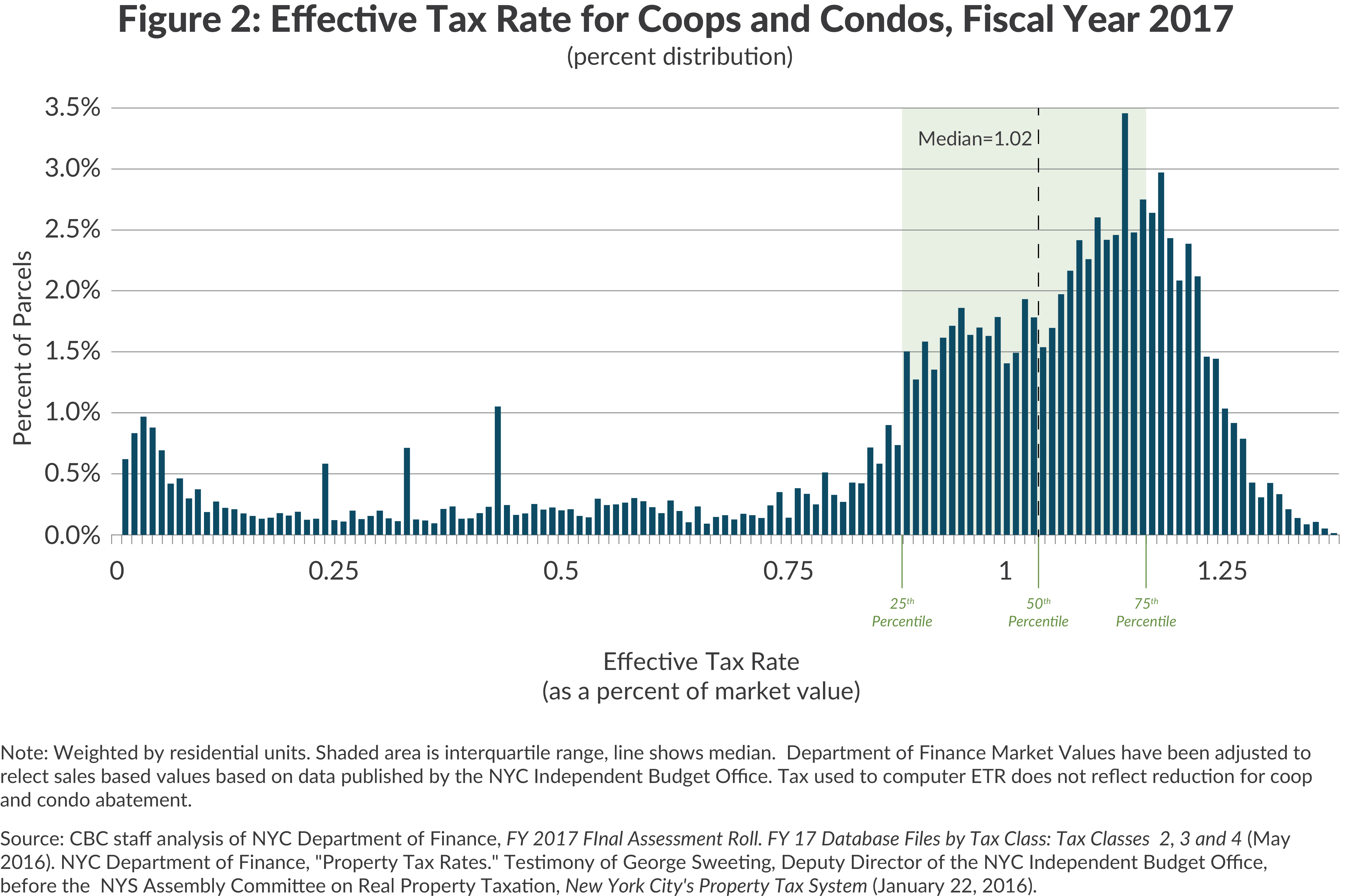

How Should I Interpret This Supplemental Property Tax Notice? r, 121, enacted in march 2023, simplified the individual income tax system in montana and, effective january 1, 2024, reduced the number of tax brackets from seven to two. The united states relies much less.

Source: dsj.us

Source: dsj.us

Do The Math Supplemental Wage Taxes For New Yorkers DSJ, New york state income tax tables in 2024. News from the office of the new york state comptroller.

Source: www.cpajournal.com

Source: www.cpajournal.com

New York State's Real Estate Transfer Tax The CPA Journal, $1 billion plan will fix new york state’s continuum of mental health care. Don't forget, the deadline for filing.

Source: www.kitces.com

Source: www.kitces.com

Finding Your Tax Equilibrium Rate When Liquidating Retirement Accounts, Withholding rates, and tax brackets. The oecd on average raised 5.4 percent of total tax revenue from property taxes, compared to 10.4 percent in the united states.

Source: cbcny.org

Source: cbcny.org

NYC Effective Tax Rates CBCNY, The new york bonus tax percent calculator will. First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items such.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, The new york bonus tax percent calculator will. 121, enacted in march 2023, simplified the individual income tax system in montana and, effective january 1, 2024, reduced the number of tax brackets from seven to two.

Source: github.com

Source: github.com

Does the NYS supplemental tax create a cliff? · Discussion 1350, The oecd on average raised 5.4 percent of total tax revenue from property taxes, compared to 10.4 percent in the united states. To date, the irs has issued guidance on changes to the following areas for 2024:

2024 Taxable Equivalent Yield Table For New York State And City.

The new york bonus tax percent calculator will.

What’s More—Depending On Income Or Locality Within The State, Some Taxpayers.

Since the irs views bonuses as supplemental income, employers must withhold taxes on bonuses according to irs regulations for supplemental income, which is a separate.